In the world of trading, various tools and indicators have been developed to aid traders in making informed decisions. One such tool is the ATR Pocket Option Indicator индикатор ATR Pocket Option, which is widely recognized for its ability to help traders assess market volatility and make strategic trading moves. This article delves into the intricacies of the ATR indicator, how it functions, its advantages, and how traders can effectively utilize it in their trading strategies.

What is the ATR Indicator?

The Average True Range (ATR) is a technical analysis indicator that measures market volatility by decomposing the entire range of an asset price for a specific period. Introduced by J. Welles Wilder Jr. in his book, “New Concepts in Technical Trading Systems,” the ATR has become a staple in the toolkit of many traders.

The ATR is not used to indicate price direction; rather, it focuses on volatility. In volatile markets, the ATR value tends to be higher, while in steady markets, it decreases. This characteristic makes the ATR especially valuable for traders who wish to understand market dynamics, evaluate risk and determine potential price movements.

How the ATR Pocket Option Indicator Works

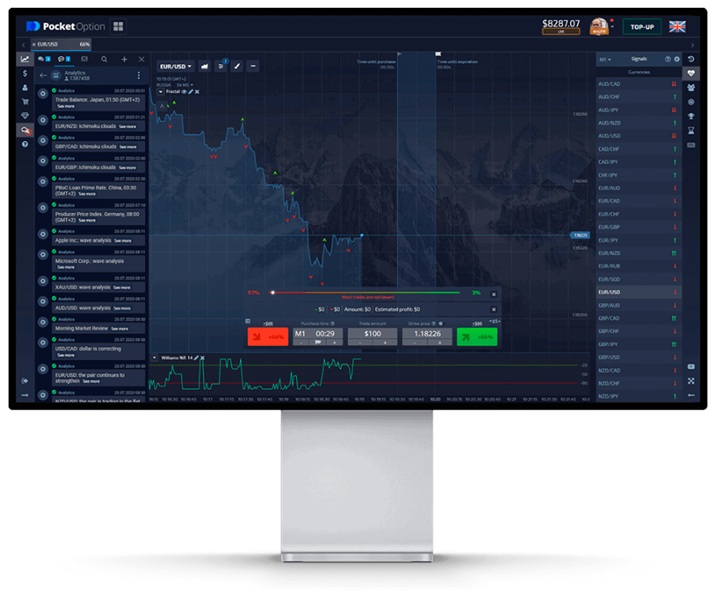

The ATR Pocket Option Indicator simplifies the calculations of the standard ATR by integrating seamlessly with the Pocket Option trading platform. Here’s how it works:

- True Range (TR): The first step involves calculating the true range, which is the greatest of the following:

- The difference between the current high and the current low.

- The difference between the previous close and the current high.

- The difference between the previous close and the current low.

- Average True Range (ATR): Once you have the true range, the ATR is computed by taking an average of the true ranges over a set number of periods (typically 14) to smoothen out volatility over time.

This process results in a single line on the chart that traders can use to gauge market conditions. The ATR value is typically plotted below the price chart and can provide critical insights into expected price movements.

Benefits of Using the ATR Pocket Option Indicator

Traders using the ATR Pocket Option Indicator can realize several benefits, including:

- Volatility Assessment: The ATR provides a clear picture of market volatility, allowing traders to adjust their strategies based on current market conditions.

- Improved Risk Management: By understanding volatility through the ATR, traders can better set their stop-loss orders and take profit points, thus managing risk more effectively.

- Adaptable to Various Markets: The ATR can be applied to various trading instruments, including forex, stocks, and commodities, making it a versatile tool across different markets.

- Avoiding False Signals: By monitoring volatility, traders can differentiate between genuine price movements and noise, thereby reducing the risk of making impulsive trades based on false signals.

How to Use the ATR Pocket Option Indicator in Trading

Using the ATR Pocket Option Indicator effectively involves integrating it into your trading strategy. Here are some practical ways to utilize the ATR:

1. Setting Stop Loss and Take Profit Orders

One common application of the ATR is in determining optimal stop loss and take profit levels. A general rule of thumb is to set your stop-loss orders a multiple of the ATR value away from the entry price. For instance, if the ATR is 20 pips, setting a stop loss at 2 x ATR (40 pips) could protect your position from normal market volatility while allowing for potential price movements.

2. Identifying Market Volatility Breakouts

Traders often look for breakouts in volatile conditions. When the ATR shows a significant increase, it may signify that the price is about to make a substantial move. A trader might enter a trade if the price breaks through a resistance level during such times, anticipating a strong trend.

3. Combining with Other Indicators

To enhance trading strategies, the ATR can be effectively used in conjunction with other technical indicators like Moving Averages or RSI (Relative Strength Index). The combination can provide a more comprehensive view of the market, increasing the chances of successful trades.

Interpreting ATR Values

To effectively use the ATR, it’s important to understand how to interpret its values:

- Low ATR Values: A low ATR indicates a less volatile market. This could suggest a period of consolidation, where traders might be cautious about making aggressive trades.

- High ATR Values: A high ATR value signals increased market volatility. This often indicates a strong trend or breakout situation, where opportunistic traders may capitalize on significant price movements.

Cautions When Using the ATR Indicator

While the ATR Pocket Option Indicator has its advantages, traders should also be aware of its limitations:

- Lagging Indicator: The ATR is a lagging indicator and is based on past price movements. Therefore, it may not always predict future volatility accurately.

- Not Directional: The ATR does not indicate the direction of price movement; it only measures volatility. Traders need to rely on additional indicators or analyses to determine price direction.

Conclusion

The ATR Pocket Option Indicator is a powerful tool in the arsenal of traders looking to gauge market volatility and make informed trading decisions. Whether you’re a beginner or an experienced trader, understanding how to effectively utilize this indicator can enhance your trading strategies and improve your overall trading success. By incorporating the ATR into your trading plan, you can better manage risk, identify trading opportunities, and navigate the dynamic world of financial markets with greater confidence.